Optimize support for customers and staff using organizational knowledge

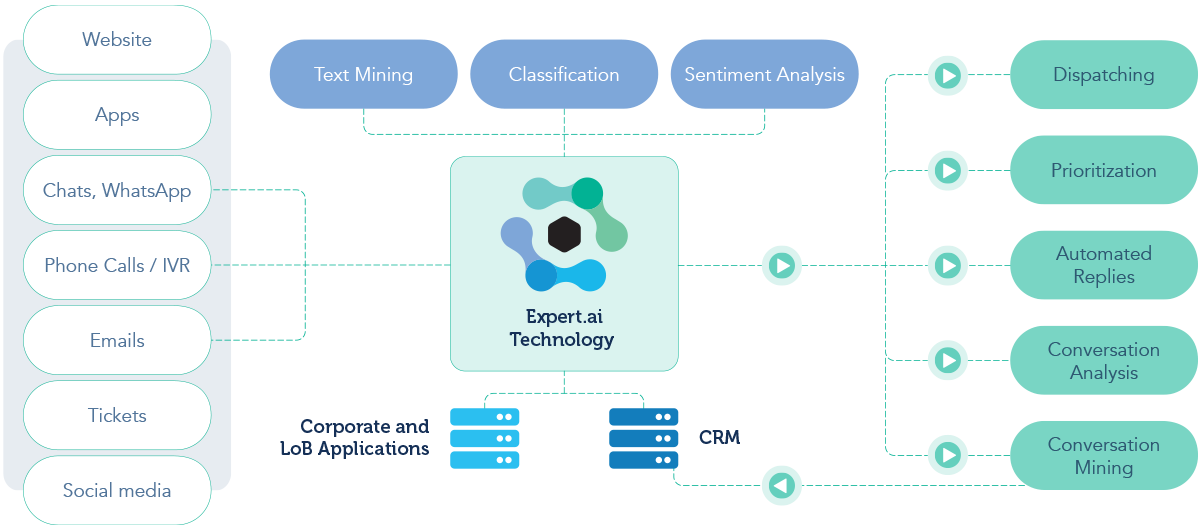

Banks and financial operators today are facing customer interactions that are increasingly digital and multichannel. They need to be able to manage the relationship with customers—from acquiring new customers, retaining existing ones and supporting internal staff—regardless of the channel used (website, mobile app, chatbot, phone conversations, social media, intranet, etc.).

Expert.ai solutions automatically understand meaning, context and sentiment similar to how people do, but faster and with greater accuracy and consistency. Expert.ai offers advanced AI capabilities that are ready to use and create customer service applications for even the most complex multichannel requirements.

Expert.ai’s artificial intelligence-based solutions help banks and financial services organizations analyze and organize massive amounts of communications from email, chat, social media, quickly and effectively so that they can optimize customer communication and back office processes across digital channels.

Categorize requests automatically

Analyze each message based on a customized intent, type and department. Extract relevant entities and information (name, address, product or service names, account number, etc.) mentioned in the text or in attached files.

Analyze inquiries and messages

Identify content, entities and topics mentioned in email, chats, support tickets, etc. and identifying the communications that are most urgent or may trigger critical issues.

Respond and route automatically

Send automatic responses to the most frequent standard requests, forward messages to the most appropriate support teams and enable complex RPA and CRM rules based on intent.

Understand sentiment

Identify sender intent and sentiment to expedite response for frustrated customers to reduce churn.